Random Thoughts on Long-Term Fitness Industry Success – Installment 6

It’s time for the March installment of my thoughts on fitness career insights.

1. Four broad categories make your business successful.

I used to think that having a successful business in the fitness industry – or any industry, for that matter – was about two things: Lead Generation and Lead Conversion. Lead generation refers to how many people are inquiring about your gym, and lead conversion is how many of those people actually join your gym (or sign up to train with you). This is a very shortsighted view, though, as it doesn’t take into account two super important systems components.

Retention is what ultimately differentiates the most successful gyms and trainers in the business, and it really doesn’t fall under either of these categories. Retention is what magnifies your lead generation and conversion efforts over the course of a training career.

Efficiency is the other factor that you only understand once your business gets larger. Let’s say you crush it on lead generation and lead conversion – and your retention is great – but you have a massive staff, insane utility expenses, an unreasonable lease, and are open 24 hours a day. You aren’t very efficient, so the high expenses (and headaches) offset the gross revenue figures you’re generating. Knowing how to “trim the fat” from an expenses standpoint is imperative to manage growth. Little things like switching to a new credit card processor or different payroll company can save you thousands without impacting your client experience at all.

If your business is struggling, take a look at those four factors and pick where you can improve the most – and the quickest. Pick the low-hanging fruit first.

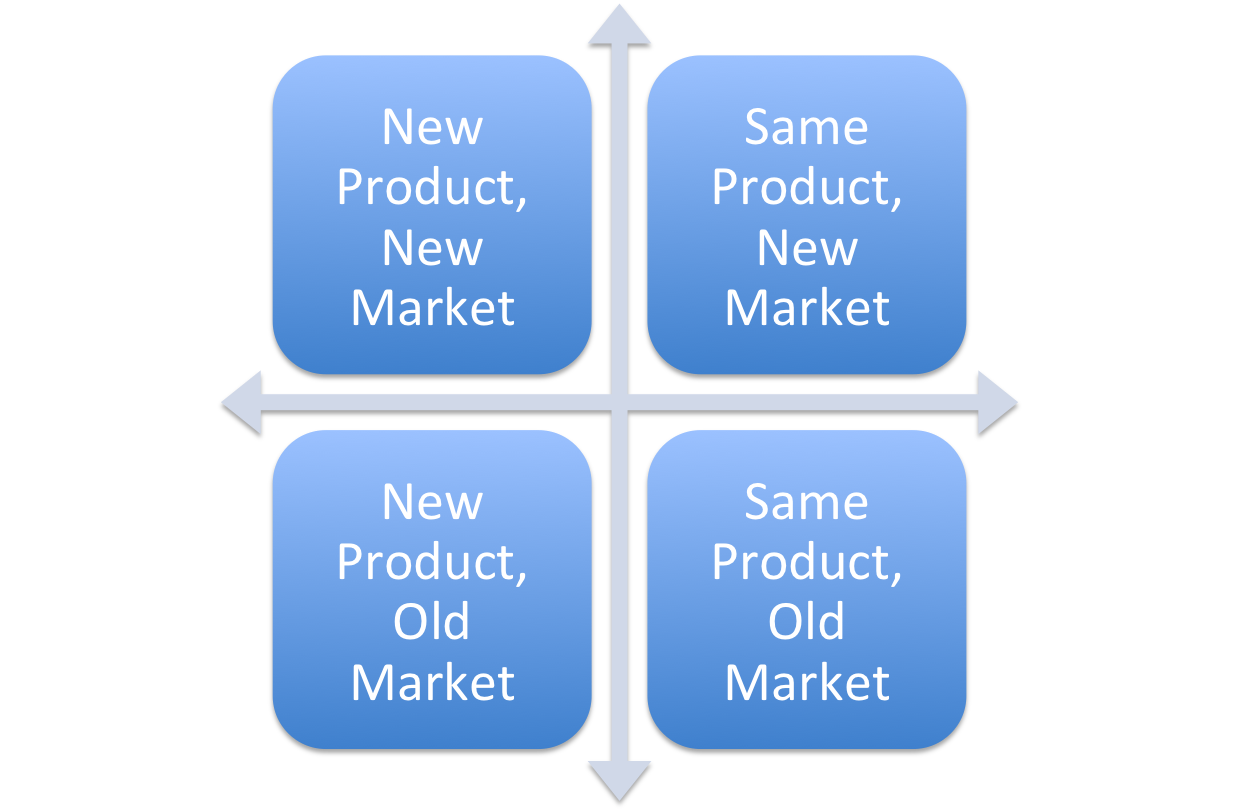

2. There are four kinds of products/services.

I learned this all the way back in my undergraduate business education. You have new and old products/services, and new and old markets/customers.

I’ll use Cressey Sports Performance as an example. We are well known for our work with baseball players.

When we get a new baseball player referral, it’s the same product, old market scenario. We have all the systems in place for it. The line gets blurred a bit when the same product is rolled out to a new geographic area (i.e., nationwide vs. local), so you could argue that it “blends” with…

…Same product, new market: If we decided to take our baseball training principles and push them heavily to quarterbacks, swimmers, and tennis players, then it would be a same product, new market scenario.

When we first offered massage therapy, nutrition consultations, pitching instruction, and CSP clothing to our baseball players, that was a new product, old market scenario.

If we decided to start producing a CSP branded javelin and pushing ourselves heavily to track and field throwing athletes, that would be a new product, new market scenario.

When you consider all these options, it becomes readily apparent that the two easiest ways to grow are using everything other than the new product, new market scenario. It requires extensive resources and a huge leap of faith. It’s far easier to sell an old or new service to an existing marketing than it is to acquire a brand new customer base completely. And, it’s easier to sell your same service to and old or new market because you can fall back on your results and your reputation.

As with point #1 from above, it’s easiest to pick the low-hanging fruit.

3. YOU are an appreciating asset that is tax-deductible.

With tax time at hand, here’s an interesting observation: when you invest in yourself relative to your profession, it’s usually tax deductible. Maybe it’s a seminar you attend or DVD you purchase. It might be your fitness recertification fees, or what you spend on a CPR/first aid refresher. Perhaps it’s some new equipment you purchase to use with clients, or the mileage you drive to observe a fellow professional in action so that you can learn.

You can’t write off the Starbucks you drink, the new watch you got, or the fancy car in your driveway (well, unless it’s a business vehicle, but that’s a loaded topic). The point is that the government essentially incentivizes you to invest in yourself and your professional development, but it doesn’t reward blowing money on “stuff” that doesn’t make you better at what you do professionally or more likely to make money.

With that in mind, as the spring/summer seminar circuits start up, remember that the cost of attending a seminar – from registration fees to travel expenses – are deductible against your income. When you consider state and federal income taxes, most folks will actually get back upwards of 25-50% of what they pay for the seminar in question – and that doesn’t even include the financial impact it could have on you if it helps you to become a more well rounded, marketable, and successful fitness professional. Invest in yourself and you’ll never regret it.

We’re hosting one such game-changing seminar at Cressey Sports Performance in Jupiter, FL on April 9. Brian St. Pierre, the Director of Performance Nutrition at Precision Nutrition, will be delivering a fantastic nutrition talk that was a big hit when he presented it at our Massachusetts facility last year. The early-bird registration deadline is fast approaching, and you can learn more about it HERE.